This is an excerpt from Only the Differentiated Survive: The 6 Trends Shaping Tequila in 2026 a new tequila trends forecast from The Tequila Report. Download the entire report free. Research for this forecast comes from our twice-annual survey of American tequila consumers and The Tequila Report readers, with supplemental data from other sources.

Tequila has become an expensive hobby. What began as an accessible spirit category has transformed into a luxury pursuit, pricing out casual consumers and creating structural vulnerabilities in the market.

Mass-market producers maintain affordability through scale and efficiency. Their industrial operations absorb cost volatility and pass savings to consumers. Artisanal brands face a different reality. Subject to agave market fluctuations, labor costs, and production constraints, craft producers struggle to balance premium positioning against the risk of pricing out the educated consumers who form their core audience.

This creates a painful tension. Craft tequila brands must command premium pricing to sustain operations and fund innovation. Yet excessive pricing alienates the very consumers most likely to appreciate their differentiators and become loyal advocates.

Craft tequila's core consumer base is demographically narrow and economically concentrated, creating substantial vulnerability to economic downturns.

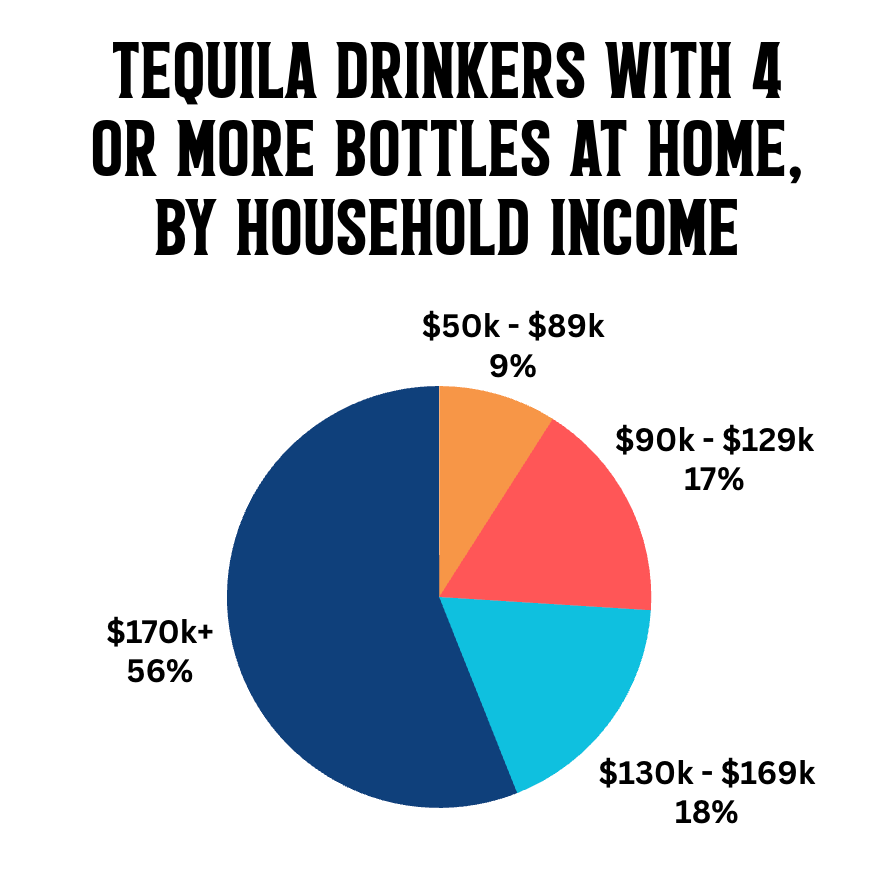

The Tequila Report's research reveals stark patterns. Among consumers maintaining four or more tequila bottles at home, 56 percent report household incomes of $170,000 or higher - roughly double the U.S. median. This concentration intensifies at higher consumption levels. Among avid collectors with 11 or more bottles, nearly two-thirds earn $170,000 or more annually.

Age compounds this demographic concentration. Nearly half of casual tequila consumers with three or fewer bottles are 39 years or younger. Among serious hobbyists with 11 or more bottles, 63 percent are 50 or older. The category's passionate advocates skew older, wealthier, and increasingly removed from younger, more price-sensitive consumer segments.

Our research on tequila spending reveals consistent price ceilings.

For blanco tequila, the critical threshold is $55 per bottle. Eighty-seven percent of consumers typically pay that amount or less, with more than half spending $45 or less. Only 13 percent regularly purchase blancos above $65. This matters because craft producers increasingly offer premium blancos exceeding these price points, pricing themselves beyond where most consumers are willing to venture.

Reposado tequila shows similar patterns. Eighty percent of drinkers typically spend $65 or less per bottle, with 20 percent willing to exceed that threshold.

What proves most revealing is this: price sensitivity transcends income. Consumers with household incomes of $170,000 or more spend virtually identical amounts on blanco and reposado compared to consumers earning $89,000 or below.

When asked what elements define a suitable go-to brand, consumers prioritize in this order: additive-free status, aroma and flavor, and price. Price ranks third, suggesting that quality and authenticity matter deeply. Yet this ranking masks a harder truth revealed in spending data: while consumers claim price ranks behind product qualities, their actual purchasing behavior demonstrates that price ceilings are real.

Premium positioning and premium pricing work only to a point. Beyond that point, even affluent consumers balk.

Consumers are already beginning to trade down within the spirits category. When economic headwinds intensify, even affluent consumers adjust spending habits. In the last three months of 2025, sales of tequila bottles priced at $100 and up plummeted by 18 percent, according to Nielsen.

This pricing challenge extends beyond craft producers. Major spirits conglomerates face identical pressures, their balance sheets long dependent on ultra-premium margins now threatened by consumer trade-down behavior.

Diedre Mahlan, interim CFO at Diageo, articulated this reality plainly during a December 2025 earnings call: "The consumers are under some pressure, so we're seeing a bit of a shift between the super-premium—Don Julio and Casamigos—to premium."

Diageo's response reveals the scale of the problem. The company is "leaning into Astral," a brand with an average price of $32, to capture consumers migrating downward. Yet even Diageo, with massive scale and marketing resources, cannot simply command premium pricing in an uncertain economy. The company must chase consumers down the price ladder.

This trade-down dynamic manifests in format shifts as well. Consumers are purchasing smaller bottles - 375ml half bottles and 50ml miniatures - allowing for lower-cost trial and consumption. SipSource data documents this trend starkly. In the three months of 2025, sales of 375ml reposado tequila soared 74 percent year-over-year, while 50ml reposado sales jumped 65 percent. By comparison, 750ml reposado sales rose only 21 percent.

Summary: There are real price ceilings for tequila purchases, despite the wealth of many hobbyists, and economic uncertainty now drives trade-down behavior even among major producers.

7Reposado sales have been steadily increasing for multiple years, at the expense of both blanco and more aged expressions. An increase in reposado sales should not be interpreted as an increase in overall sales in the tequila category, but rather a shifting of consumer preferences toward reposado, fueled partially by bartenders increasingly using reposado for cocktails, rather than blanco.