This is an excerpt from Only the Differentiated Survive: The 6 Trends Shaping Tequila in 2026 a new tequila trends forecast from The Tequila Report. Download the entire report free. Research for this forecast comes from our twice-annual survey of American tequila consumers and The Tequila Report readers, with supplemental data from other sources.

The tequila industry has long treated its market as monolithic and its consumers as a largely homogeneous group. The reality tells a different story. The market is fragmenting into two distinct segments with divergent behaviors and preferences.

According to Nielsen NIQ data1, approximately 900 agave spirits brands sold at least one bottle at a Nielsen-reporting retail location in 2025, including mezcal. The top 10 brands - Don Julio, Cuervo, Patrón, Casamigos, 1800, Espolón, Lunazul, Hornitos, Teremana, and Cazadores - control 71% of total sales by dollar volume, per Nielsen.

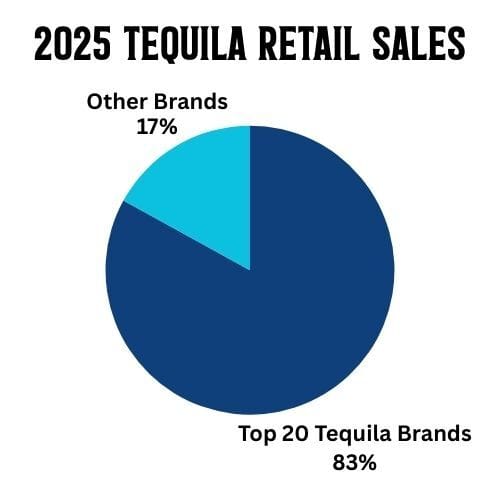

The top 20 brands capture 83% of all agave spirits sales dollars. These market leaders maintain near-universal distribution, rely on efficient industrial production at massive scale, and deploy comprehensive marketing programs to sustain brand awareness and drive demand.

Yet despite these structural advantages, this dominant segment is contracting. Top 20 brand sales declined 1.5% from 2024 to 2025.

This contraction reflects broader patterns in American beverage alcohol consumption. Overall spirits sales fell 4.1% in 2025, though ready-to-drink beverages bucked the trend. Tequila continues to outperform all other spirits categories. Beer and wine sales have reached 20 year lows.

Several factors explain this decline. The normalization of cannabis, economic uncertainty, and generational shifts in drinking habits all play a role. Gallup reports that only 54% of American adults now consume alcohol, marking an 87-year low. This represents a stunning shift: in 2023, 62% of Americans drank alcohol. That constitutes a 13% drop in category size within 24 months.

Against this backdrop, it might be obvious to expect smaller tequila brands to face insurmountable odds. Yet craft tequila brands are flourishing.

These brands are typically produced by smaller distilleries using traditional methods and chemical-free processes. Their marketing emphasizes authenticity and heritage. And their sales growth reflects genuine consumer appetite: craft brands2 increased sales 28.5% over the past year, according to Nielsen.

This sharp divergence reveals the market's true fracture. Industrial giants are losing ground while artisanal producers are gaining it. The tequila market is no longer monolithic. It is split into two.

The mass-market tequila consumer prioritizes accessibility and familiarity over production methods, distillery history, or brand ownership. This segment predominantly enjoys tequila in cocktails - margaritas, palomas, tequila and soda - rather than neat. Brand identity matters less in these contexts. Consumers make quick purchasing decisions based on recognition and price.

A smaller but rapidly expanding segment operates with entirely different priorities. These consumers prioritize differentiation, innovation, and narrative. They make deliberate purchasing decisions informed by online tequila education resources and community knowledge. They care deeply about how tequila is made, who makes it, and why it matters.

The market is splitting along consumption philosophy and consumer sophistication. Mass-market buyers seek accessibility and familiarity. Enthusiasts seek authenticity and discovery.

Summary:

The tequila boom is not over in the United States. But growth has shifted away from mass market brands and toward smaller, artisanal producers

1 Nielsen primarily tracks larger retail stores and systematically under-samples independent liquor retailers. Additionally, its data excludes on-premise sales at bars and restaurants, capturing only approximately 30 percent of total agave spirits sales.

Brand concentration is even more pronounced in on-premise placements, where large producers dominate shelf space and menu positioning. The Nielsen snapshot, while useful, understates the market's true competitive dynamics in hospitality channels.

2 No formalized industry definition for "craft tequila" currently exists. For this analysis, The Tequila Report created a craft segment using approximately 130 brands listed as Premium Brand Partners on the Agave Matchmaker website.

These brands are presumed to have committed to producing tequila free of chemical enhancers and represent a substantial portion of the widely recognized additive-free tequila category. Examples include LALO, Tequila Ocho, G4, El Tesoro de Don Felipe, Don Fulano, and Cazcanes.

One notable exclusion: Patrón is not classified as craft for this analysis. Although Patrón employs artisanal production methods, its massive scale and position as the third best-selling brand overall place it firmly within the mass-market segment.